Tax Reform Bills: Freeing Nigeria from economic cesspit

I have been following, you have been following, and Nigerians at large have been following. We have moved past conversations and consultations. And now, here we are at the passage of the Tax Reform Bills by the House of Representatives, marking a change in Nigeria’s tax system.

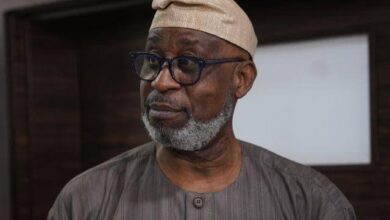

What comes to mind when you hear the word reform? What do you think of when you hear the Tax Reform Bill? After all this time, many Nigerians now have a clearer understanding of what is happening. But when you think of it, who do you envision? There is no other person than the Executive Chairman of the Federal Inland Revenue Service, Dr Zacch Adedeji.

After taking office in May 2023, President Bola Ahmed Tinubu inherited a situation that required urgent action. Our tax system has been plagued by inefficiencies, low compliance rates, and inadequate coverage. The country also faced challenges like the need for more transparency, improved coordination between federal and state tax authorities, and the lack of a clear, modernised tax framework to support long-term economic growth.

President Tinubu was fully aware of those shortcomings before and after assuming office. The one thing he could do was put a capable man in charge: the Tax Boss. The government made tax reform a priority in its broader economic agenda, and Dr Zacch has demonstrated commitment to ensuring these reforms are efficiently implemented.

The Tax Boss knew that no matter how brilliant the reform looked on paper, it had to work in practice. Under his leadership, FIRS accelerated internal reforms, digitised processes, automated over 80 per cent of returns processing, and integrated new modules into the TaxProMax system to make compliance easier and smarter. This is what Nigerians needed: we are not waiting for change; we are making it happen.

By the end of 2024, four draft bills emerged: the Nigeria Revenue Service Bill, the Nigeria Tax Administration Bill, the Nigeria Taxation (Consolidation) Bill, and the Joint Tax Board Bill. Each was designed to streamline laws, harmonise tax administration, and expand the tax base without overburdening taxpayers. The National Assembly opened its doors to scrutiny with public hearings, tough questions, governors’ perspectives, and expert feedback. Some proposals have been revised, such as the decision to retain the current VAT rate.

On March 13, 2025, the House of Representatives passed the Tax Reform Bills. The Senate is expected to debate the bills after its current recess, resuming plenary on April 29, 2025. Once the Senate passes them, they will be sent to the President for assent. This is the final stretch.

But let’s not forget how we got here. It took presidential will, expert input, and above all, Dr Zacch. The Tax Boss has not only championed this process; he has owned it with clarity, purpose, and results. With continued execution and the right structures in place, the tax reforms will build a stronger system for everyone, from the government to everyday Nigerians.

Tax Reform Bill is not just another trend. It is the change we have been asking for. Most importantly, it is here to stay.

- Aderonke Atoyebi is the technical assistant on broadcast media to the executive chairman of the Federal Inland Revenue Service