FG: Tax Reforms Already Impacting Economy

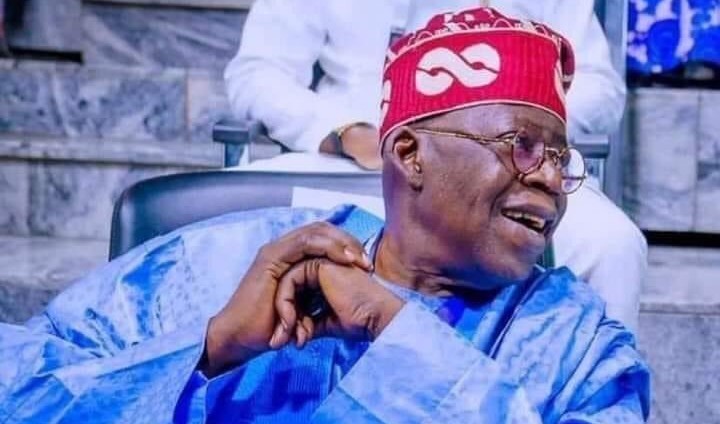

President Bola Tinubu has said that his administration’s tax reform agenda is affecting Nigeria’s economy, noting a rise in the nation’s tax-to-GDP ratio.

In a statement marking the second anniversary of his administration on Thursday, Tinubu said the reforms were not only about raising revenue but about changing the structure of the economy.

“One of our most impactful achievements has been our tax reform agenda, which is already yielding results,” the President said.

He noted that Nigeria’s tax-to-GDP ratio increased from 10 per cent to over 13.5 per cent by the end of 2024. He attributed this rise to changes in tax administration and policies.

“We are eliminating the burden of multiple taxation, making it easier for small businesses to grow and join the formal economy. The tax reforms will protect low-income households and support workers by expanding their disposable income,” he said.

The President said that essential goods and services—such as food, education, and healthcare—would now attract zero per cent VAT. He added that rent, public transportation, and renewable energy are exempt from VAT.

“We are ending the era of wasteful and opaque tax waivers. Instead, we have introduced targeted and transparent incentives supporting high-impact manufacturing, technology, and agriculture sectors,” Tinubu said.

He said the reforms also focus on creating a tax environment that accommodates digital jobs and remote work.

Through new export incentives, Tinubu said Nigerian businesses are now in a better position to compete in the global market.

The President also mentioned the implementation of the National Single Window project, which he said has reduced delays in international trade.

“To promote fairness and accountability, we are establishing a Tax Ombudsman, an independent institution that will protect vulnerable taxpayers and ensure the system works for everyone, especially small businesses,” he stated.

Tinubu said a new national fiscal policy is being introduced to guide taxation, borrowing, and spending.

“This strategic framework will guide our approach to fair taxation, responsible borrowing, and disciplined spending,” he said. “These reforms are designed to reduce the cost of living, promote economic justice, and build a business-friendly economy that attracts investment and supports every Nigerian.”

The post FG: Tax Reforms Already Impacting Economy appeared first on Kano Times.